Unlocking the Potential of Open Banking in the UK

Introduction

In this comprehensive guide, we will explore the vast potential of Open Banking in the United Kingdom and how it revolutionises the financial landscape for consumers and businesses alike. Open Banking has emerged as a transformative force, offering numerous benefits that can improve financial accessibility, transparency, and innovation. Through this article, we aim to delve into the intricacies of Open Banking, its impact on the UK's financial sector, and why it holds the key to the future of finance.

Understanding Open Banking

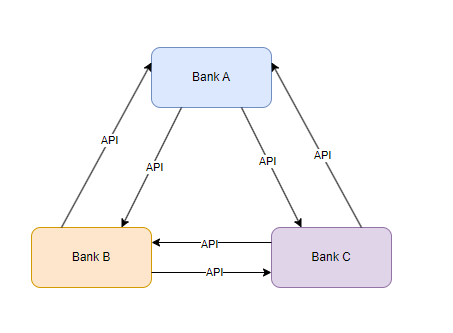

Open Banking is an innovative concept that allows customers to share their financial data securely and electronically with authorised third-party providers. It enables banks and financial institutions to open their data through Application Programming Interfaces (APIs), fostering collaboration with other providers. By doing so, Open Banking empowers customers to access a wide range of financial services from different institutions through a single platform.

H3 - The Advantages of Open Banking

1. Enhanced Financial Control

With Open Banking, customers gain greater control over their finances. They can view all their accounts from different banks in one place, providing a holistic view of their financial health. This consolidated approach facilitates budgeting, expense tracking, and financial planning, empowering individuals to make informed decisions about their money.

2. Increased Financial Transparency

Open Banking promotes transparency by ensuring that customers have easy access to their financial data. This transparency builds trust between customers and financial institutions, fostering a healthier and more accountable financial ecosystem.

3. Seamless Payment Solutions

Open Banking facilitates seamless and instant payments through APIs, reducing transaction times significantly. This benefits businesses and consumers alike, as it streamlines the payment process and eliminates the need for traditional, time-consuming payment methods.

Open Banking's Impact on the UK Financial Sector

The implementation of Open Banking has had a profound impact on the UK's financial sector. The increased competition and collaboration among financial institutions have led to the emergence of innovative financial products and services. As a result, customers now have access to tailored financial solutions that meet their specific needs and preferences.

Furthermore, Open Banking has spurred the growth of fintech companies, creating a vibrant ecosystem of startups and technology-driven enterprises. These fintech firms leverage the power of Open Banking APIs to develop groundbreaking applications that simplify financial management, investment, and lending processes.

Embracing Open Banking: A Step Towards Financial Inclusion

One of the most significant advantages of Open Banking is its potential to enhance financial inclusion. By providing a secure and standardised platform for data sharing, Open Banking enables underserved populations to access financial services more easily. Small businesses, low-income individuals, and those with limited access to traditional banking services can now leverage Open Banking to bridge the gap and participate in the formal financial system.

Diagram - The Open Banking Ecosystem

Here is another useful article Open Banking Glossary

Open Banking Security and Privacy Measures

The widespread adoption of Open Banking is contingent upon robust security and privacy measures. Financial institutions and third-party providers must adhere to stringent data protection standards to ensure the confidentiality and integrity of customer information. Implementing strong encryption, multi-factor authentication, and regular security audits are essential to build trust and safeguard sensitive data.

The Future of Open Banking

As Open Banking continues to evolve, its potential is boundless. The ongoing advancements in technology, such as artificial intelligence and blockchain, will further enhance the capabilities of Open Banking. We can expect more personalised and sophisticated financial solutions, empowering customers to make smarter financial decisions.

Moreover, Open Banking is not limited to the banking sector alone. Industries like insurance and wealth management are also exploring the integration of Open Banking to create better and more inclusive financial products and services. Open Banking delivered by pay by link make the solution ideal for customer not present transactions, click here to read an article on this subject.

Conclusion

Open Banking has proven to be a game-changer in the UK's financial landscape. With its emphasis on transparency, collaboration, and innovation, it holds the key to transforming the way we manage our finances. By leveraging the opportunities presented by Open Banking, individuals, businesses, and the financial industry as a whole can unlock a brighter, more accessible financial future.